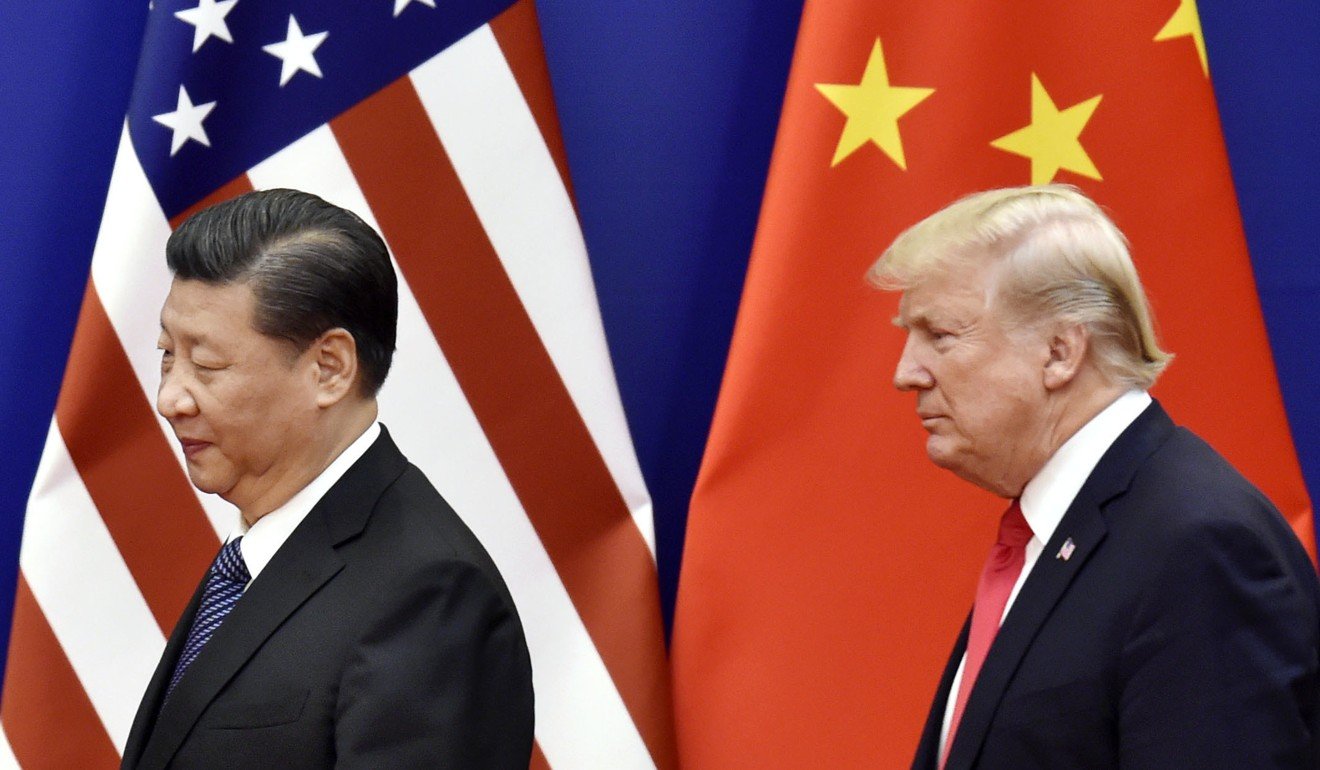

China trade war is about to get nastier & a Chinese economic collapse is now even more likely; the Chinese chickens are coming home to roost...

China trade war is about to get nastier & a Chinese economic collapse is now even more likely; the Chinese chickens are coming home to roost...

China’s objective must be to avoid, not win, a trade war with the United States. Winning, even if it’s possible, would spell catastrophe for China’s economic development. Negotiating, not counter-punching, should be China’s principal strategy.

China’s successful development is a result of continuous reform and opening up, hard work and patience, not confrontation or expedience. Even if the US tariffs stick, China’s economy can easily absorb them.

The trade dispute between China and the US is threatening to get out of control. It could lead to a collapse in confidence that could trigger a global financial crisis. The Trump administration is unlikely to change its behaviour because it subscribes to the madman theory in foreign relations and is not sophisticated enough to understand the chain reaction from a confidence crisis.

Only China’s restraint could calm the markets and avoid a crisis.

The Trump administration started the fight with a 25 per cent tariff on US$34 billion of Chinese imports, and China retaliated in a tit-for-tat fashion. Since then, the US has proposed a 10 per cent tariff on a further US$200 billion of Chinese imports to be implemented at the end of August. China has promised to respond.

Trade war: China to retaliate after US proposes fresh tariffs

Such actions may be rational in the first round. Both sides want to change the other’s behaviour. The Trump administration wants China to scale down its industrial policy. China wants to impose a cost on the US to deter similar action in future. The second round is not rational any more. It is becoming a macho contest.

The economic significance of the tariffs has been hugely exaggerated: 25 per cent on US$34 billion is an extra US$8.5 billion. China’s exports are likely to top US$2.4 trillion in 2018. The tariff impact is therefore symbolic. Even the 10 per cent tariff on US$200 billion only amounts to an additional US$20 billion. The numbers are not big, in relative terms.

The tariffs shouldn’t significantly affect China’s competitiveness. China’s labour cost is less than one-fifth of the OECD level. Adding 10 or 25 per cent to it won’t affect China’s competitive position relative to the US or other developed economies. While some production could relocate to other emerging economies, they just don’t have the scale to take over significant value chains from China.

So, if China simply didn’t respond to US tariffs, the economic damage would be quite limited. Picking a fight, on the other hand, would affect confidence at home and around the world, which could do a lot of damage to China’s economy.

China’s exports have been subject to more anti-dumping measures – far more serious trade barriers than normal tariffs – than the rest of the world combined. And, yet, China’s exports have risen 12-fold in the past two decades. Scale and speed have conferred such a huge advantage to China’s competitiveness that trade barriers in any one market don’t slow it down meaningfully.

The costs of the US’ new tariffs are likely to be borne by US consumers. The US economy is overheating. Sellers are gaining pricing power. If costs goes up, they are likely to be passed onto consumers. This will pressure the Federal Reserve to increase interest rate quicker than it currently plans. As the US economy is quite dependent on debt, its trade actions, if others don’t respond, will end up hurting America mostly.

Watch: The trade war and its impact on consumers

China should see the trade tensions as a sign that its current economic structure needs to be reformed to fit better into the world. China has grown rapidly for four decades. Its peculiarities haven’t bothered the world because its impact was small. Now it is the second-largest economy, its peculiar features are exerting macro influences on the world.

If the world remains peaceful, China could become the largest economy at market exchange rates by 2030. Those peculiarities would exert even more pressure, which may cause the world order to collapse. It is in China’s interest to reform its economy further and become more like an advanced economy.

China must get ready for the next battle on the exchange rate front, a much more serious proposition than the imposition of tariffs. The Japanese yen tripled in value against the US dollar during its four decades of economic development. China’s exchange rate has appreciated minimally in the same time frame.

That is the main reason China’s economic peculiarities have not slowed it down. China differs from other large economies in the extent of government interference in the market. Its inefficiency is accommodated by low exchange rates. If the renminbi were to double in value, China’s economy couldn’t grow without major restructuring.

If China doesn’t reform, it is only a matter of time before an alliance of major economies forces Beijing to double the value of the yuan. Waiting until that moment is not in China’s interest.

The best option is to reform now and appreciate the currency later. The current trade dispute could be used as a catalyst to initiate reforms. If the US complains that China’s tariffs are higher, why not lower them to the same level? It would be good for China to do that, anyway.

If others complain that China’s industrial policy contains excessive government subsidies, why not scale them back and rely more on the market to create business and advance innovation? What have the subsidies done for the economy so far? After pouring in tens of billions of dollars, has China produced one significant innovation? The chances are that the market can do better.

It has become fashionable to attribute China’s success to its peculiarities. Government leadership in infrastructure development has been key to China’s success. Other developing economies should learn that.

The other aspects of government interference in the economy are mostly detrimental. If China had privatised its state-owned enterprises before joining the World Trade Organisation, it wouldn’t have the debt bomb it faces right now.

Misinterpreting China’s success could lead to serious mistakes. China should learn from Japan’s experience. It believed for a time that it had found a better model. The reality was that its exchange rate was undervalued. After the yen was brought up to the OECD level, it has stagnated ever since. China should not repeat the mistake.

Andy Xie is an independent economist

Comments

Post a Comment